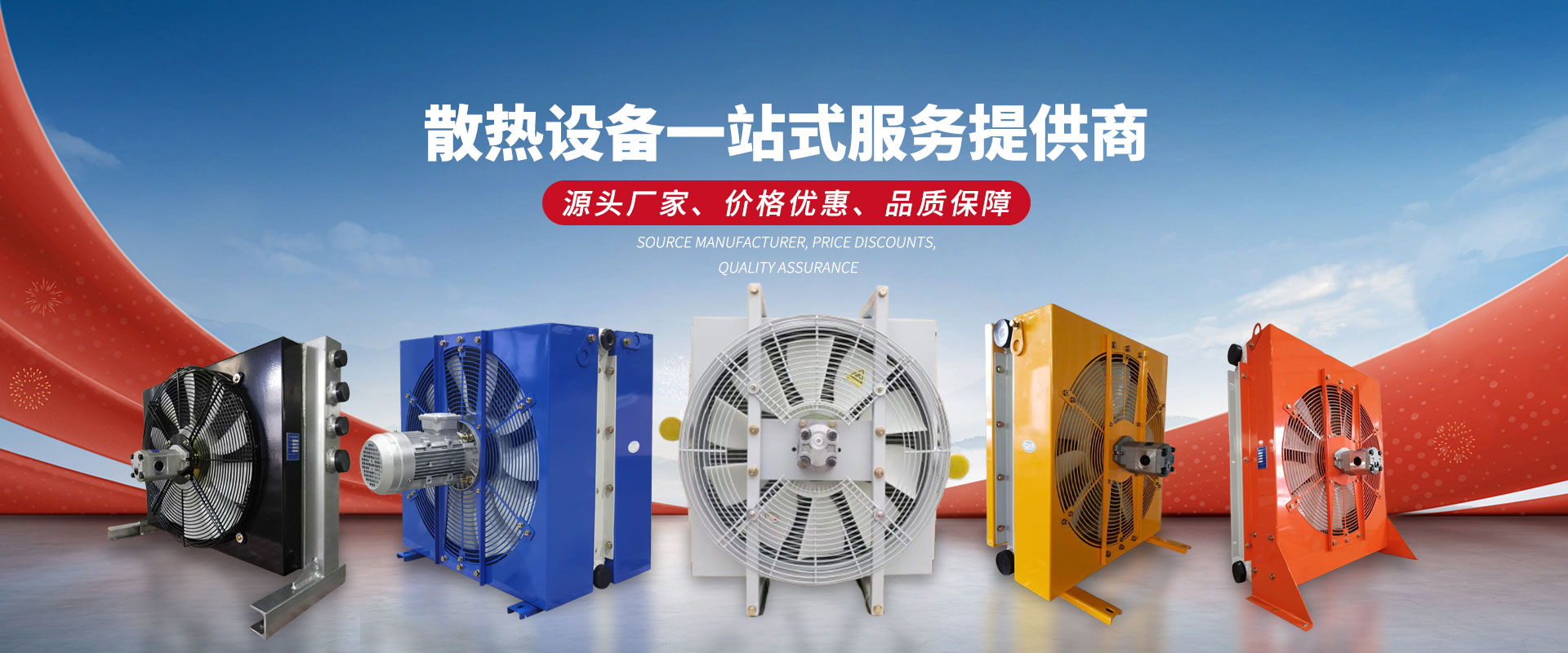

Product Exhibition Hall

產(chǎn)品展廳

咨詢(xún)服務(wù)熱線(xiàn):133-0380-7111

Why do everyone choose Jiuhe Heat Exchanger

為什么大家都選久合換熱器

實(shí)力廠(chǎng)家 · 現(xiàn)貨直銷(xiāo)

廠(chǎng)家直銷(xiāo)、品質(zhì)有保障,產(chǎn)品暢銷(xiāo)全國(guó)各地,多次獲得客戶(hù)良好反饋。

經(jīng)驗(yàn)豐富 · 高度認(rèn)可

公司立足于業(yè)內(nèi)多年,擁有豐富的行業(yè)經(jīng)驗(yàn),獲得業(yè)界的高度認(rèn)可。

技術(shù)人才 · 實(shí)力團(tuán)隊(duì)

公司配備多名技術(shù)、研發(fā)生產(chǎn)人才、擁有數(shù)十年的研發(fā)生產(chǎn)經(jīng)驗(yàn)。

雄厚實(shí)力 · 品質(zhì)無(wú)憂(yōu)

公司擁有成套核心設(shè)備,技術(shù)成熟穩(wěn)定,保證所有產(chǎn)品高質(zhì)量產(chǎn)出。

誠(chéng)信經(jīng)營(yíng) · 共同發(fā)展

我們堅(jiān)守誠(chéng)信原則,與客戶(hù)建立長(zhǎng)期合作關(guān)系,共同努力,共同發(fā)展。

精心服務(wù) · 放心售后

針對(duì)性的滿(mǎn)足客戶(hù)的需求,為客戶(hù)提供量身定制的解決方案。

Cooperation Cases

合作案例

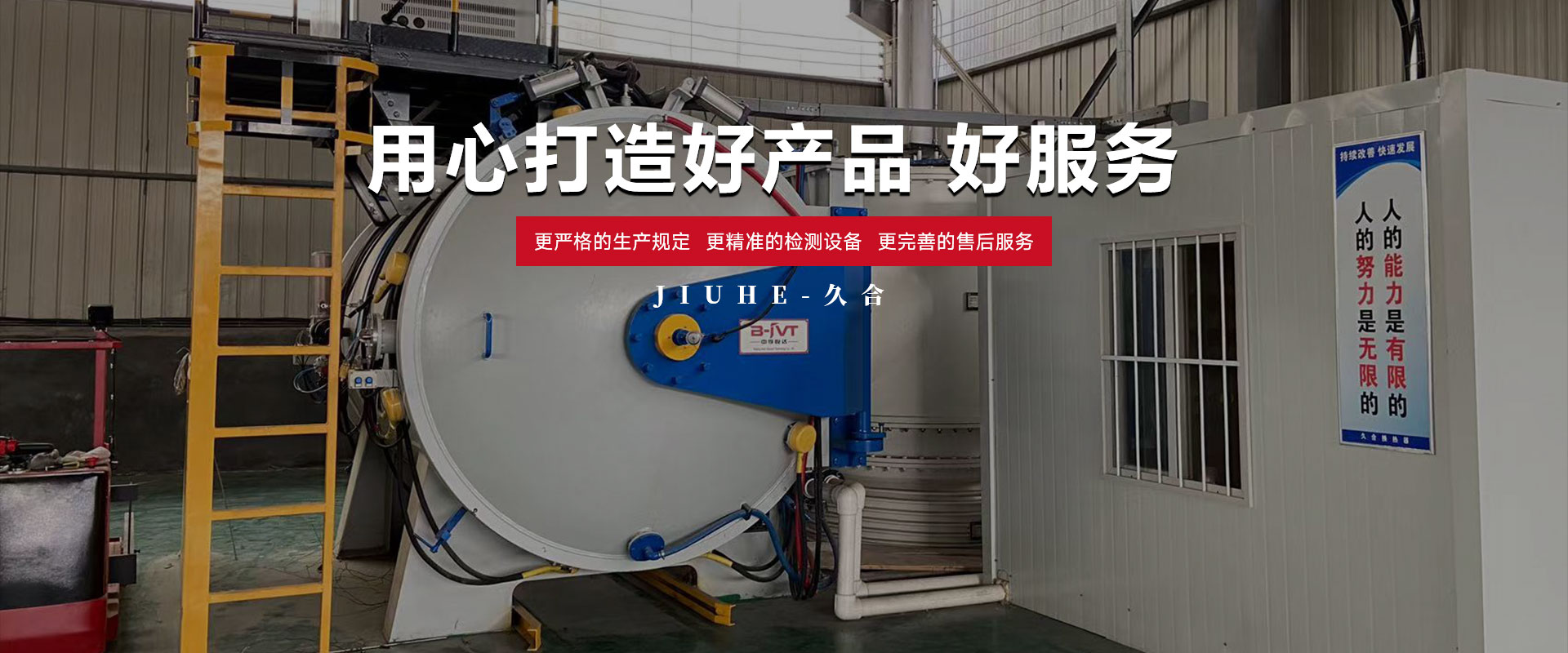

公司簡(jiǎn)介

誠(chéng)信立足,創(chuàng)新致遠(yuǎn)

新鄉(xiāng)久合換熱器有限公司位于河南省新鄉(xiāng)市牧野區(qū)東馬坊工業(yè)園區(qū),毗鄰京珠、菏寶高速,交通便利,是熱交換熱器類(lèi)產(chǎn)品生產(chǎn)企業(yè),具有十多年設(shè)計(jì)生產(chǎn)經(jīng)驗(yàn)。 主要產(chǎn)品有:各種用途的液壓油散熱器、發(fā)動(dòng)機(jī)散熱器、中冷器及液壓油箱等。產(chǎn)品廣泛用于:工程機(jī)械、礦山機(jī)械、農(nóng)林機(jī)械、石油化工、機(jī)車(chē)、液壓和潤(rùn)海系統(tǒng)等。 主要加工和檢測(cè)設(shè)備——翅片成型機(jī)、全自動(dòng)超聲波清洗線(xiàn)、高溫合金釬焊夾具、芯體裝配機(jī)、真空釬焊爐、數(shù)控激光切割機(jī)、數(shù)控剪板機(jī)、折彎?rùn)C(jī)、沖床、鉆床、搖臂鉆床、鋸床、點(diǎn)焊機(jī)、全自動(dòng)氬弧焊機(jī)、散熱器試漏機(jī)器、散熱器壓力試驗(yàn)機(jī)等, 針對(duì)不同應(yīng)用領(lǐng)域,我們分別有標(biāo)準(zhǔn)化、系列化的產(chǎn)品供您選擇,我們更有技術(shù)優(yōu)、經(jīng)驗(yàn)豐富、做事認(rèn)真的工程技術(shù)人員為您提供快速而個(gè)性化的解決方案,使您獲得優(yōu)性?xún)r(jià)比的產(chǎn)品與服務(wù)?! 【煤蠐Q熱器始終秉持“科技立業(yè),真誠(chéng)奉獻(xiàn)”的經(jīng)營(yíng)理念。以?xún)?yōu)良的質(zhì)量、完善的服務(wù),優(yōu)良的信譽(yù),致力于拓展國(guó)內(nèi)外市場(chǎng)。

查看更多 →

實(shí)力企業(yè)

公司專(zhuān)注熱交換熱器類(lèi)產(chǎn)品的研究、設(shè)計(jì)、生產(chǎn)、銷(xiāo)售的現(xiàn)代化企業(yè)

技術(shù)優(yōu)勢(shì)

公司配備多名研發(fā)生產(chǎn)人才、擁有數(shù)十年的研發(fā)生產(chǎn)經(jīng)驗(yàn)

品質(zhì)服務(wù)

致力于提供周到的售后服務(wù),機(jī)制靈活,針對(duì)性的滿(mǎn)足客戶(hù)需求

News and information

新聞資訊